Setting up a foriegn owned company in Indonesia is the first step to expanding your business operations.

There are many options foreign business owners can opt for, but the most common type are a Foreign-Owned Company (PT PMA) or Representative Office.

All have their benefits, however, one is likely better suited based on your business needs and expansion plans.

What is a PT / PMA?

If you are a foreign investor in Indonesia that wants sole control of your business, then establishing a PT PMA is the best option you can opt for.

PT PMA is the only legal entity in Indonesia that allows 100% foreign ownership.

However, each sector has its own set of rules regarding allowed business activities and the maximum number of shares that foreigners can own, as determined by the Positive Investment List.

A foreign-owned company in Indonesia is commonly referred to as a PMA – a Limited Liability company with foreign capital. It’s a common and preferred company type or structure chosen by foreign businesses and investors, as it is designed to meet the legal requirements set out by the government.

All Indonesian companies that receive direct foreign investment must be in the form of;

PT (Perseroan Terbatas/Limited Liability company) + (name of the PMA company).

For example: “PT. Legal Legends Indonesia”.

PT can be classified as an open, closed, domestic, foreign, private, or public PT.

Here is a simple table explaining the differences between PT. PMA (foreign owned-company) and PT. PMDN (local company):

Differences between PT. PMA and PT. PMDN

| PT PMA (foreign owned-company) | PT PMDN (local company) |

|---|---|

| Limited liability company with foreign direct investment, ranging from 1%-100% foreign shares | Limited liability company with 100% local/domestic direct investment |

| Shareholders are not legally liable for company liabilities | Shareholders are not legally liable for company liabilities |

| A minimum of 2 shareholders (individual and/or entity) | A minimum of 2 Indonesian shareholders (individual and/or entity) |

| A foreign individual can become a director or a commissioner | A foreign individual can become a director but not a commissioner |

| Minimum authorized capital and paid-up capital requirement is IDR 10 billion | Small: IDR 1 billion – 5 billion Medium: IDR 5 billion – 10 billion Large: more than IDR 10 billion |

| Foreign employees are allowed to work in a PT PMA | Foreign employees are allowed to work, only in a medium and large-sized PT PMDN |

Starting a PT. PMA (foreign-owned company) is the best way legally for foreign-owned businesses to operate and generate revenue in Indonesia.

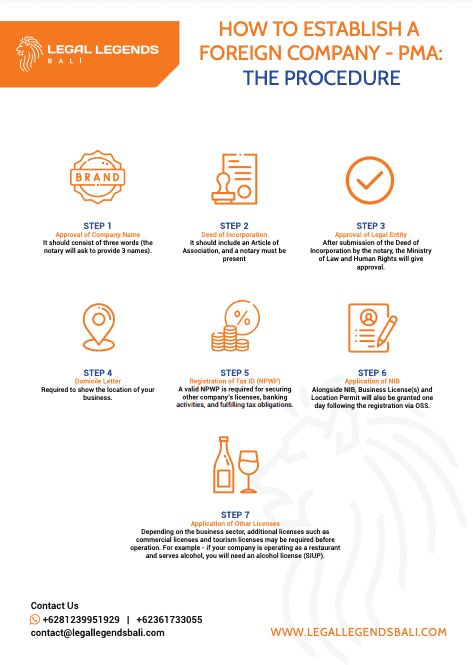

How to Establish a Foreign Company – PMA:

The Procedure

Step 1 – Approval of Company Name

It should consist of three words (the notary will ask to provide 3 names).

Step 2 – Deed of Incorporation

It should include an Article of Association, and a notary must be present.

Step 3 – Approval of Legal Entity

After submission of the Deed of Incorporation by the notary, the Ministry of Law and Human Rights will approve.

Step 4 – Domicile Letter

Required to show the location of your business.

Step 5 – Registration of Tax ID (NPWP)

A valid NPWP is required for securing other company’s licenses, banking activities, and fulfilling tax obligations.

Step 6 – Application of NIB

Alongside NIB, Business License(s) and Location Permit will also be granted one day following the registration via OSS.

Step 7 – Application of Other Licenses

Depending on the business sector, additional licenses such as commercial licenses and tourism licenses may be required before operation. For example – if your company is operating as a restaurant and serves alcohol, you will need an alcohol license (SIUP).

Registering a Business in Bali

| Industry | Max. foreign ownership |

|---|---|

| Pharmacy | 85% |

| Hotels less than 3 stars | 67% |

| Event organizing (for weddings, retreats) | 67% |

| Meetings, incentives, conferences (MICE) | 67% |

| Trading for import, export, and distribution | 67% |

| SPA (Sante Par Aqua) | 51% |

| Web portals | 49% |

| Car dealer | 0% |

| Jewelry retailer | 0% |

| Shops and beauty salons | 0% |

0% percent means that foreigners are not permitted by the government to own within that business sector.

Indonesia has over 2000 different business classifications (KBLIs). Contact our team with more information about the specific business activities you are interested in conducting in Indonesia, and we’ll be happy to help out with your registration process. Click Here

Real Sector Investment in Bali

Real sector investment is an investment with visible assets or clear form.

This type of investment involves productive goods, meaning that it can generate profits in the future even if it does not generate current income, but its value will increase from year to year if you manage it well.

Examples of Real Sector Investment:

- Home property investment

- Land property investment

- Gold investment

- Business capital investment

Real sector investment in Indonesia is divided into three groups, namely:

- Open a business field

- Open a business field with conditions

- Closed business fields are then recorded in the negative investment list

Note – there is the Negative List of Investments (DNI) which is a regulation that prohibits foreign investors from investing in certain sectors in Indonesia.

The DNI list was made for investors, (especially foreign investors), before deciding to invest in Indonesia.

The Negative List of Investments are investments that are 100% not allowed to be owned by foreigners.

Meanwhile, the Positive List of Investments are investments that may be owned by foreigners (depending on the percentage of ownership rules of the business sector).

Here is a list of both:

| NEGATIVE LIST OF INVESTMENTS | POSITIVE LIST OF INVESTMENTS |

|---|---|

| Historical and archaeological heritage (temples, palaces, inscriptions, sacred place, ancient buildings) | Pharmacy |

| All forms of gambling | Art gallery |

| Catching fish species listed in appendix I of the Convention on International Trade in Endangered Species (CITES) | Cigarette industry |

| Taking or using coral from nature | Retail trade by mail order and internet |

| Management and Operation of Radio Frequency Spectrum Monitoring Station and Satellite Orbit | Internet cafe (Warnet) |

| Ozone-depleting chemical industry | Work training |

| Lifting of Valuable Objects from the Load of a Sinking Ship | Medical device industry: Class C (IV Catheter, X Ray, ECG, patient monitor, orthopedic implant, contact lens, oximeter, densitometer) |

| Telecommunication, Shipping Navigation Aids and Vessel Traffic Information System (VTIS) | The field of natural tourism is in the form of the exploitation of ecotourism activities and services as well as facilities in forest areas |

| Implementation of Motor Vehicle Type Testing | Pest control or fumigation services |

| Government Museum | Performing arts building |

| Industry of Chlor Alkali Manufacturing with Mercury Process | Public survey/polling services and market research |

| Pesticide Active Material Industry | Overseas sea mode transportation for passengers |

| Land Transport Passenger Terminal Operation | Wood pellet industry |

| Alcoholic Beverage Industry : Wine | Power generation above 10 MW |

| Beverage Industry Containing Malt | Knitting fabric industry |

| Alcoholic Beverage Industry | Data communication services |

| Implementation and Operation of Motor Vehicle Weighing | Internet access service |

| Operation of Aviation Navigation Services | Content service telecommunications network operation (ringtone, premium sms, etc.) |

| Management and Operation of Radio Frequency Spectrum Monitoring Station and Satellite Orbit | Geothermal survey services |

| Oil and gas drilling services at sea |

Based on the Negative List of Investment, foreigners can’t make or produce alcohol beverages in Indonesia.

However, foreigners can carry out wholesale trade in alcoholic beverages. This means that foreigners in Indonesia can own a company (min. medium-sized) that can distribute alcohol to a small company (must be owned by Indonesian citizens) that sells alcohol beverages.

To put it simply, as a foreigner you can’t own the alcohol industry, you can only distribute it.

Wholesalers of liquor/alcohol (importers, distributors, and sub-distributors) must have a PMA first, and you must have: SIUP-MB (alcoholic beverage trading business license), distribution network, and in special places.

Initial Capital Needed to Set Up a Company in Bali

To register your business you will need a ‘paid-up capital’ of at least IDR 2.5 billion equal to 25 percent. This can be proved by issuing a Shareholder Capital Statement Letter.

The PMA deposit capital of 25% is a general rule when a company is being set up.

However, if in the future you are planning to sponsor an investor KITAS, your notarial deed must state that you have deposited 100% of capital

What is Paid-Up Capital Amount?

All PMA(s) are required to fulfill the minimum paid-up capital of IDR 10 billion. Shareholders of the company are required to sign off a Capital Statement Letter stating that the shareholders have sufficient funds to meet the required capital.

What does this mean for you?

Paid-up capital in Indonesia means the actual amount of funds injected into a company by shareholders. These funds are then exchanged for shares and issued for shareholders in the company.

These paid capitals will then be used for the initial and day-to-day company operations such as debts, payroll, and other expenses.

Minimum Capital Investment Requirements for a PMA

The Investment Coordinating Board in Indonesia (BKPM) specifies the minimum capital requirements for a PMA to be IDR 10 billion depending on the industry foreigners invest in.

This amount of minimum capital is just a rough plan and will be invested as per the investment plan proposed by the company – over a period of 3 years.

The investment plan can be either cash or fixed assets. The value of land and buildings is excluded from its amount.

In general, the minimum capital is required for all industries to sustain the local and small-medium companies while encouraging foreign investments in large-scale companies.

For industries that are more capital intensive, like, financial and banking services, natural resources extraction, manufacturing, etc., higher minimum capital is expected and will be listed in the investment plan.

Important Information – Even though minimum paid-up capital and investment plan are not the same, both are very important when establishing a forigen owned company (PT PMA.) The minimum paid-up capital represents the value that must be injected into your business. Like an investment plan, the capital can be both in the form of money and other assets with a total value of IDR 10 billion. However, the paid-up capital requirement remains the same even in the case of several business classifications.

Forms of Injection of Minimum Paid-Up Capital

The minimum paid-up capital can be injected in the form of cash into the company’s bank account, or in other assets. If the paid-up capital is put in with assets instead of cash, the value of these assets is determined based on current market prices.

However, the value of buildings and land is excluded from the capital unless it is a company’s primary business activity in the field.

The details of the payment in assets must also be recorded in the Deed of Establishment (DOE), and the deadline for submission of the capital statement letter is 60 days after the DOE is signed.

This completion process can now be done online.

The Timeline to Set Up a Company in Bali

The standard timeline for the PT PMA registration across Indonesia is approx. 16 working days.

However, compared to Jakarta and other bigger cities, Bali has a less consistent processing system. Realistically the process will take 1 to 3 months for registration to be completed.

Interested in doing business in Indonesia?

Keep reading…

Representative Office in Bali (Branch Office)

To grow your business, a representative office can be a major good step.

A Representative Office can be created and implemented for foreign investment (PMA), local PT, CV (limited partnership), UD (trading business), and many more.

So, you can make a main branch of your PT. PMA, for example:

If you already have a PT. PMA in Jakarta and want to develop the company by expanding the branch in Bali, then this is done by creating a representative office in Bali (a branch office).

In comparison to other countries, registering a representative office in Indonesia is simpler and does not require any capital.

Fact – the disadvantage of having a representative office is that you are unable to participate in a variety of economic activities, such as buying and selling goods. It is unable to make a profit. It also requires the renewal of documents.

The good news is that it can still be beneficial to your company in a variety of ways, including:

- Performing market research

- Searching for potential local partners and suppliers

- Managing and establishing your branch offices across the country

- Set up in a number of provincial capitals

- Hire foreign workers

- Establish PT PMA to increase profit after 5 years

- Work for the mother company as a buying and selling agent

PMA Branch Registration

The procedure for establishing a representative office/branch depends on the type. The following are the three types of Representative Offices:

Foreign Construction Representative Office

Construction is one of Indonesia’s most thriving industries today. It boosts GDP, improves infrastructure, and makes the country more attractive to foreign investment. It is, however, now highly regulated.

If you want to be part of the booming construction industry, you can set up a foreign construction representative office. Your company’s responsibilities include construction consultation, implementation, and supervision. You have the option to hire both foreign and local workers.

However, due to the nature of the industry, there are numerous conditions:

- Complex, high-risk, and high-tech construction projects should be undertaken

- You should establish a limited liability company, which means you need to partner with a local construction company

- In joint operations, at least 50% of the construction work value should be performed in the country, with the local company performing the remaining 30%

- The local company performs 50% of the work value in construction planning, while the entire work value is completed in Indonesia

- Contractors must have the highest level of working experience (IDR 83.33 billion) or a cumulative total of IDR 250 billion over a ten-year period

To legally establish your construction representative office, you must:

- Sign up for association membership

- Get an SBU certificate from LPJK (Indonesia Construction Service Development Board)

- Obtain the BUJKA permit from BKPM (Indonesia Investment Coordinating Board)

- Process your domicile permit

- Have your tax registration number (NPWP)

- Process your SIUJK (construction business permit) from the local government where you are operating

- Have your company registration number (NIB)

With all of the documents and fees, the process is complicated, long, and maybe confusing for

some people.

Foreign Trade Representative Office

Despite its name, this office is not permitted to conduct direct business in the country. It can act as a buyer’s or seller’s agent, but only on behalf of the parent company. It is also unable to generate invoices. It is a good place to set up an office for any marketing-related activities.

A foreign representative office is very similar to setting up a foreign trade representative office. You’ll still need someone to oversee it. However, as a representative head or assistant to the main representative, only those with at least three years of work experience and a related educational background are qualified.

There are several steps to take in order to set up this office:

- Appoint a representative head

- Gather your requirements, which include a domicile letter, letter of reference or statement, letter of appointment

- Submit your requirements and application to BKPM to receive a temporary license called SIUP3A

- Obtain your local tax registration number (NPWP)

- Receive your company registration certificate (NIB) by submitting all your requirements to the Ministry of Industry and Trade

- Get a permanent SIUP3A (Foreign trade company representative business license)

Foreign Representative Office

A general foreign representative office, which can perform a variety of tasks for the parent company, is the most simple of your options. The following are the steps for establishing a Foreign Representative Office:

- Choose an office representative and who will be the head of Representative Office*

- Collect the necessary documents, including a work permit and company representative resume, a notarized letter of appointment and appointment, and a letter of reference (branch deed, domicile permit (SKTU), branch NPWP)

- Submit the paperwork to BKPM

*For the branch office organizational structure, the head of the branch office is referred to as “head of a branch office or kepala cabang” not as director. The title “director” only applies to the head of PT PMA.

In addition, someone who is already a director of PT PMA cannot serve as head of a branch office.

Regulations between government institutions are sometimes confusing and out of sync. So to be safe, it would be better if you make a branch office where the head of the branch is an Indonesian. While you are positioning another job position in the branch office.

The job positions in the branch office organizational structure that can be selected are general manager as the highest position and manager as the least position.

To make it easier for you, here are the documents you must prepare when you start the process of making a representative office:

- A copy of existing PMA license

- A copy of shareholders passport

- A copy of lease agreement for branch office

- Exact address of the branch office*

It takes approximately 2 months to receive all your licenses.

Company Tax in Indonesia

When conducting business you should always be 100% compliant with the country’s regulations. Because of Indonesia’s forever-changing rules and laws, abiding by these can become confusing and more difficult than normal.

Once your company is officially registered, it will need to handle several corporate taxes, depending on business activities and overall financial performance. The rules and regulations are constantly changing, so we would strongly advise using a professional for business tax in Indonesia.

Tax Policy for PMA

Tax Facilities

Every PMA business owner will be subject to tax.

PMA can be referred to as a Taxpayer who invests in certain business fields in certain regions which receive high priority on a national scale, can be given tax facilities in the form of:*

- The reduction in Net Income is a maximum of 30% of the total investment made.

- Accelerated Depreciation and Amortization (reduction in the value of intangible assets).

- Compensation for losses that are longer than 5 (five) years but not more than 10 (ten) years.

- The imposition of Income Tax on dividends is 10% unless the rate according to the applicable tax agreement stipulates lower.

*Terms and conditions apply, not everyone can get these facilities.

Our tax consultant team will be glad to assist you.

Corporate Tax Requirements in Indonesia

Taxpayers can choose to use a flat fee (also known as a final tax rate) of 0.5% on gross income received for 3 years and 3 years the gross turnover does not exceed 4.8 billion.

This applies as long as you meet the following criteria:

- The company was registered no more than 3 years ago

- The gross annual revenue is below IDR 4.8 billion

After the 3 years or gross turnover has exceeded IDR 4.8 billion, the rate applied is 22% on taxable income (net profit after Fiscal correction).

In 2020, the Indonesian government announced the reduction of corporate income tax rates. While the income tax used to be 25% from the net profit, it was reduced to 22%.

The corporate income tax is calculated from the net income (profit) of the company.

Small businesses with an annual turnover of not more than IDR 50 billion are entitled to a 50% deduction from the standard tax rate, which is based on the proportion of taxable income generating IDR 4.8 billion of gross annual turnover.

| Annual Gross Revenue | Standard Tax Rate | Tax Facility (50% Discount) | Rate for Revenue not Subject to the Tax Facility |

|---|---|---|---|

| IDR 0-4.8 billion | 22% | 11% on the taxable income | n/a |

| IDR 4.8-50 billion | 22% | 11% to the proportion subject to the facility | 22% to the portion that is not subject to the facility |

| IDR 50 billion or more | 22% | n/a | 22% on the taxable income |

If the gross turnover is below IDR 4.8 billion, the deduction applies to all taxable income and as such will be applied as final income tax 23 at a rate of 0.5% of circulation.

Companies with income between IDR 4.8 billion – IDR 50 billion will be taxed at a rate of 12.5% of profits, while companies with income above IDR 50 billion will be subject to a rate of 22% of profits.

Note – it doesn’t matter whether your company made a profit or not – the tax is calculated from the revenue.

Some income earned by the company is also subject to final income tax withheld by third parties.

This tax is charged on residents who receive a number of different invoices, such as:

- Rental of land and/or buildings;

- Transfer of land and/or building leases;

- Costs for construction and interest income.

Because it is illegal to generate revenue through a Representative Office in Indonesia, any revenue received by the Representative Office should be transferred directly to your corporate headquarters overseas.

This method may include the repatriation of Limited Liability Companies (PT and PT PMA) in the distribution of dividends to overseas shareholders, which will be subject to Income Tax Article 26* at a general rate of 20% or according to the Tax Treaty between the countries involved, if applicable.

*PPh 26 is an Indonesian local tax imposed on income earned domestically by foreign taxpayers (both as individuals and as organizations).

Withholding tax

Corporate taxpayers are required to withhold or collect taxes (withholding tax).

The two sources of withholding tax are:

- The personal withholding tax you withhold when paying salaries (the PPH21).

- When you pay for goods and services (PPH22, PPH 23).

Withholding tax rates

The rate of withholding tax is determined by the type of service provided. The full table is too long for this article, but our team can help you figure out which withholding tax deductions apply to your company.

Here are some examples of withholding tax rates in Indonesia:

| Tax Object | Tax Rate |

|---|---|

| Land and Building Lease | 10% |

| Transfer of Land and Building Rights | 2.5% |

| Construction: | |

| Construction Work Planning | 4% / 6% |

| Construction Work Performance | 2% / 3% / 4% |

| Construction Work Supervision | 4% / 6% |

| Salaries and Wages | 5% – 35% |

| Import of Goods | 2.5% – 10% |

| Services and Lease/Rent of non Land and Building | 2% / 15% |

| Services | 0% – 20% |

Who’s going to pay the withholding tax?

Based on the regulation, every time you make a payment, you are expected to withhold tax on it. Essentially you are collecting the income tax on behalf of the recipient of the payment.

Employee salaries will be deducted if the income earned exceeds the non-taxable income (PTKP).

Each employee needs an NPWP (Taxpayer Registration Number) and needs to pay monthly income taxes and file yearly tax returns. Those who don’t have an NPWP are subject to an additional 20% charge on their tax.

Value Added Tax (VAT)

Every taxpayer has the choice to become a PKP (Taxable Entrepreneur) as a VAT collector.

For smaller businesses, the value-added tax (VAT) registration is usually not required. Taxpayers will be “obligated” to become PKP if their turnover is above 4.8 billion.

Starting April 1, 2022, the VAT rate is 11%.

If you don’t choose to be a PKP, then you don’t become a PKP and you don’t collect VAT, but if your turnover is above 4.8 billion, you must PKP. (please keep in mind this can change at any given time)

Tax on Dividends

Based on the Law of the Republic of Indonesia Number 11 2020, concerning Job Creation (Omnibus Law) Part Seven on Taxation Article 111 is granted tax exemption on dividends with certain conditions.

Following corporate taxation rules and regulations is incredibly important for running a successful, legitimate business.

Taxation Schedule in Indonesia

Some taxes should be paid monthly and some others are required to be filed annually. To give you broader overview of Indonesian taxation schedules, because there is a lot of information that constantly changes, here’s a shortened down overview:

The company’s taxes that should be reported monthly include:

- Corporate Income Tax

- Employee Withholding Tax

- Other Withholding Taxes (as well as VAT and LGST)

These taxes are usually paid before the 10th day of the following month for the withholding taxes and before the 15th of the following month for the Corporate Income Tax.

The first three taxes must be filed or reported before the 20th of the following month, whereas tax such as VAT and LGST, they have to be reported at the end of the following month.

On the other hand, taxes that should be paid annually include Corporate Income Tax, Individual Income Tax, and Land and Building Tax (district tax/ regional tax its called PBB) (for both the office and the factory or warehouse—if any).

The deadline for the first two is before filing the tax return, and the deadline for the last one is 6 months after receiving a tax notification letter from the tax office.

All taxes should be paid regionally.

We can assist you in filing company tax reports in Indonesia.

Setting up a business in Bali, Indonesia can be difficult. Get in touch with our multilingual team today.

Very excited! I really miss the ogoh ogoh parade! 👹

Wohooo!! good news